Crude Oil Edge: November 15, 2023

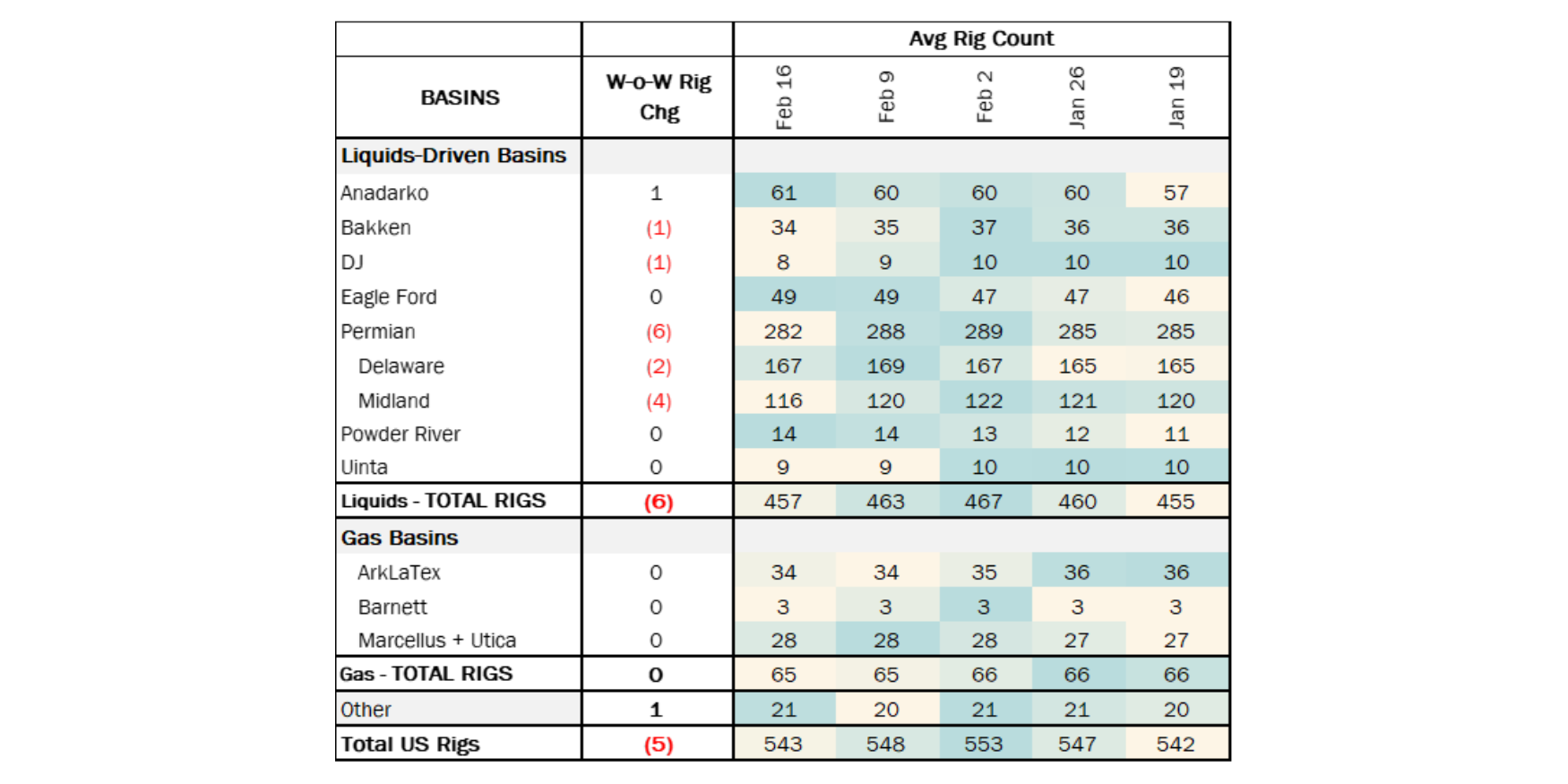

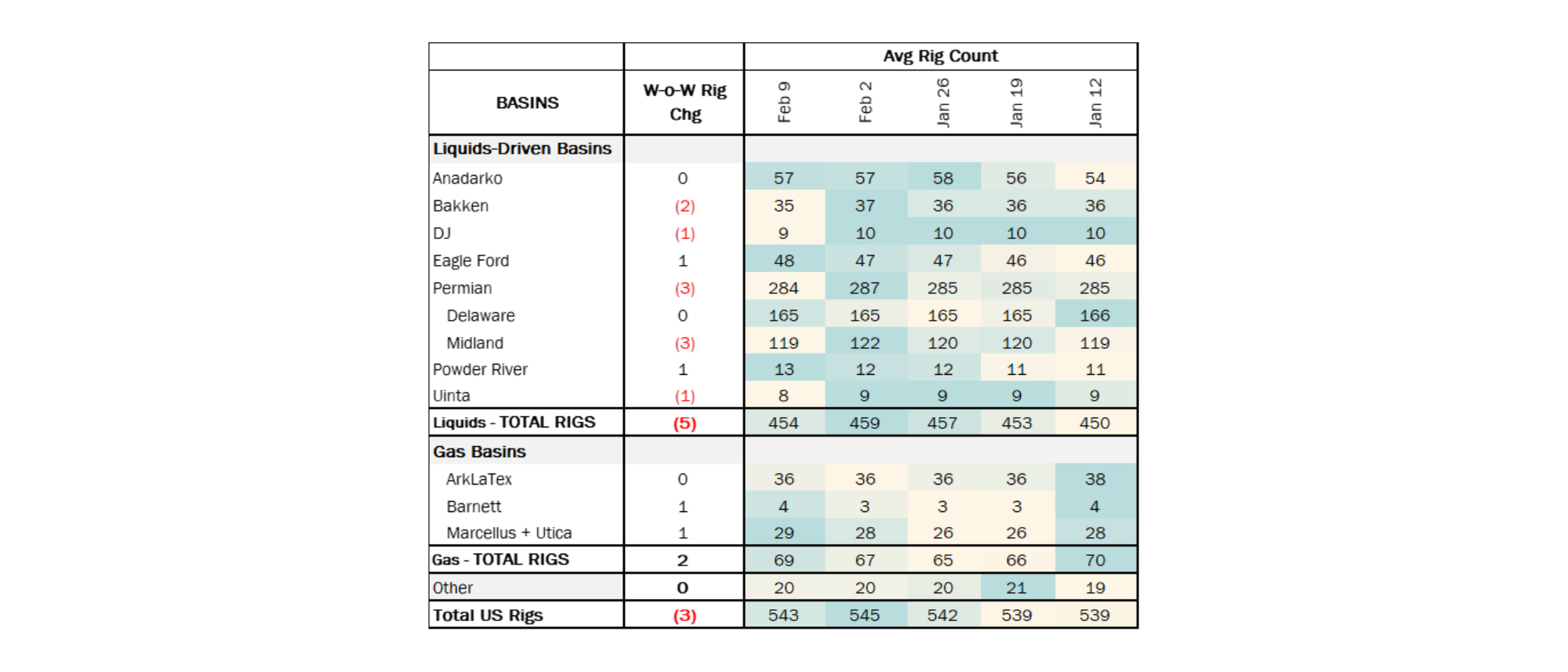

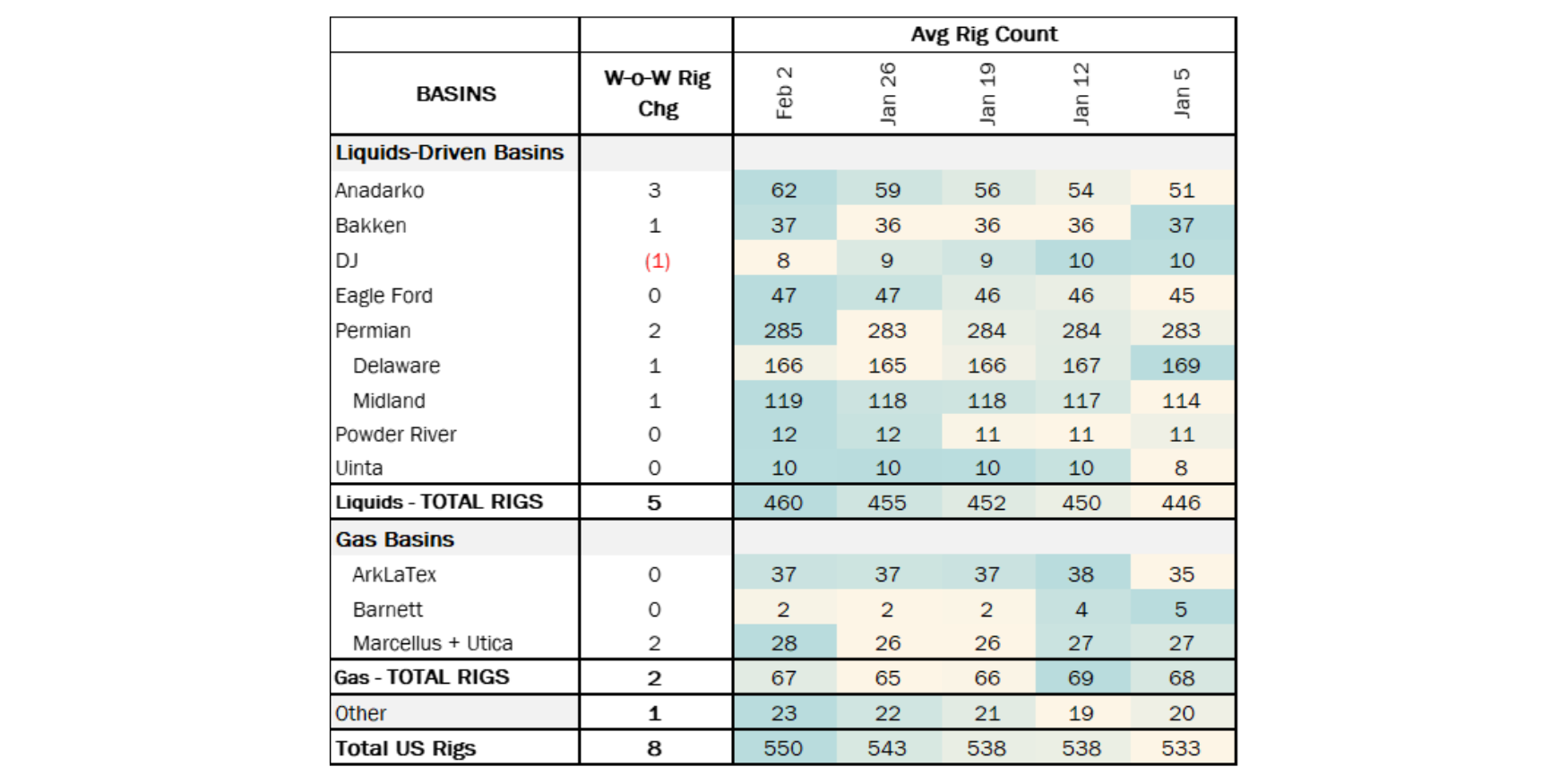

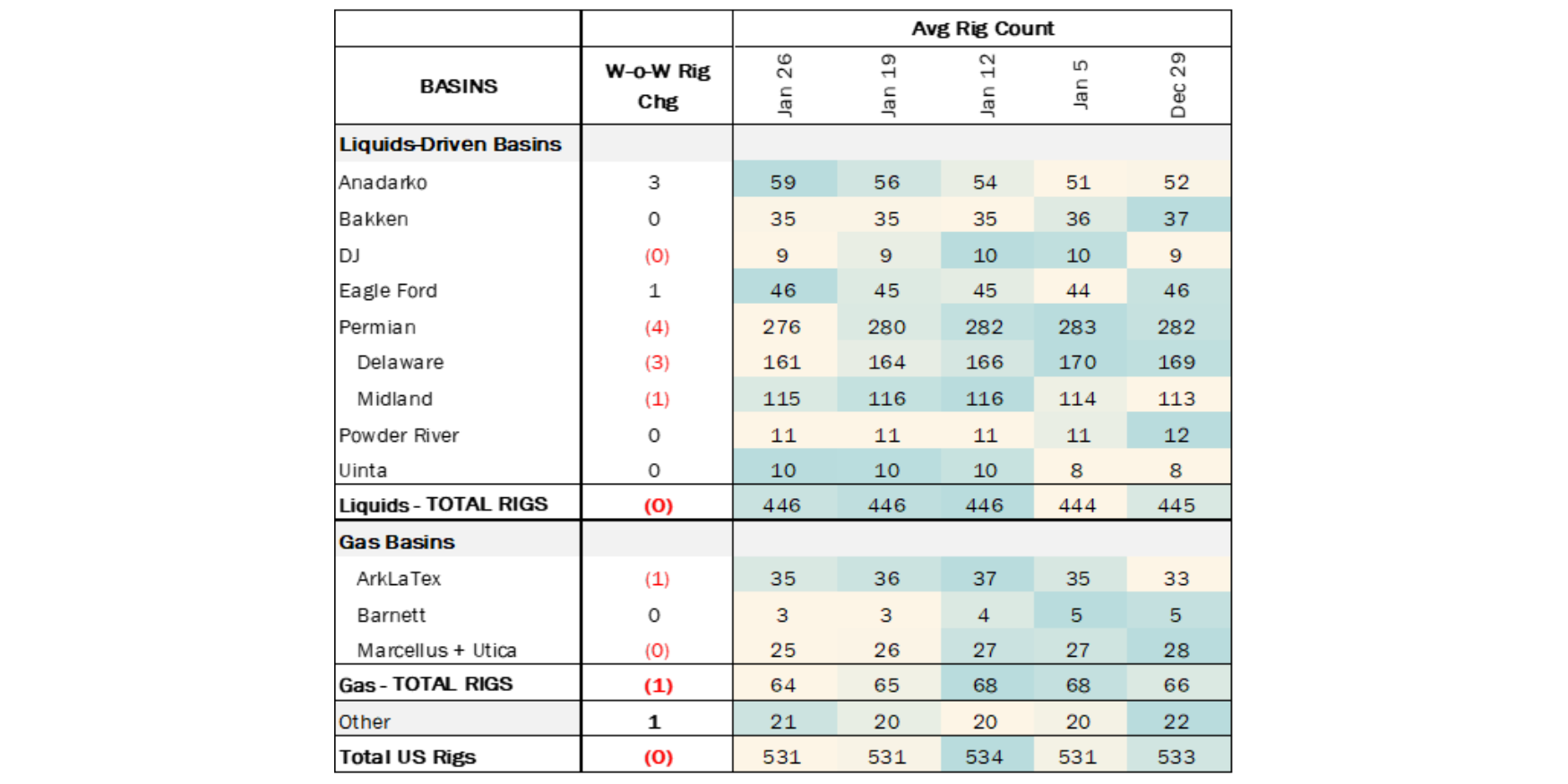

Rigs: The US rig count decreased W-o-W by 4 rigs to bring the total count to 596. Liquids basins lost 8 rigs. Each oil-driven basin lost 1 rig on average. Within the Permian, the Midland lost 2 rigs and the Delaware decreased by 1 rig.

The number of active oil-driven rigs fell by 8 in the November 3 week as market volatility continues to drag on the rig count. The decline in the number of active rigs since December has been driven by weaker commodity prices and as companies return profits to investors or pay down debt, rather than spend to increase production. However, we have seen record oil production as drilling programs continue to improve efficiency to compensate for the decline in WTI prices. Based on current producer guidance, Permian operators are planning to increase exploration and production spending next year, which could bring some rigs back to the basin.

Infrastructure:

Enbridge (ENB) plans to hold an open season in 4Q23 for Gray Oak Pipeline and offer full-path service for exports through the Enbridge Ingleside Energy Center (EIEC).

ENB announced the open season in its 3Q23 earnings report. If the tariff structure for the additional capacity is in line with current Permian-to-Corpus Christi tariffs, the Gray Oak expansion will pave the way for additional crude oil exports.

Based on current projections in the Crude Hub Model, pipelines from Permian to Corpus Christi are running at an average utilization rate of 91% in November. Permian-to-Corpus routes are above the 90% cap on committed volumes mandated by FERC, which trigger unattractive walk-up rates for shippers. As a result, we have seen additional barrels diverted to Houston and Cushing, even though Corpus Christi still has ample export capacity.

The Crude Hub Model projects Corpus Christi export terminals to average 52% utilization in November, while ENB’s EIEC terminal sees 53% utilization.

Enbridge has previously communicated a 200 Mb/d expansion on Gray Oak Pipeline is possible, and East Daley believes the expansion will be completed through drag-reducing agents.

To fill the Gray Oak expansion, EDA forecasts volume would primarily shift from Houston and some Cushing-directed barrels. Enterprise Products (EPD) recently announced plans to convert the Midland-to-Echo 2 pipeline to NGL service in December 2023, which will take some capacity offline to Houston.

The additional Gray Oak volume will lessen the pressure on pipelines from the Permian to Houston. If the Gray Oak project is successful, EDA forecasts Permian-to-Houston pipeline utilization will decline from 94% to 90% utilization by December 2024.

Storage:

We are not forecasting commercial storage this week due to the November 3, 2023 EIA Weekly Petroleum Status Report being delayed until Wednesday, November 15, 2023.

The US natural gas pipeline sample, a proxy for change in oil production, increased by 2.9% in liquids-focused basins. The Permian Basin saw a significant change, gaining 6.6% W-o-W and the Williston Basin saw a 3.10% W-o-W. The Permian basin does not have high pipeline sample coverage thus this correlation may not be as accurate.

According to US bill of lading data, US crude imports increased by ~381 Mb/d W-o-W to 7.2 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Argentina and Brazil.

As of November 10, ~1.2 MMb/d of refining capacity was offline, including downtime for planned and unplanned maintenance.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 21 vessels loaded for the November 10 week vs 23 vessels the prior week.

Regulatory and Tariffs

Presented by ARBO

Tariffs:

Marketlink, LLC has extended its temporary volume incentive rates effective December 1 through December 31, 2023.

The temporary incentive rates range from $0.90/bbl for >= 50 Mbbl to $1.05/bbl for 10 – 29 Mbbl for a light crude. The heavy crude incentive rates range from $1.18/bbl for >= 50 Mbbl to $1.33/bbl for 10 – 29 Mbbl. If applicable the temporary incentive rates are also applicable to committed shippers’I ssup excess volume. (IS24- 12, filed October 25, 2023

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at corey@goarbo.com or phone at 202-505-5296. https://www.goarbo.com/

-1.png)

.png)