NuStar Energy (NS)

Get deep, comprehensive insights on NuStar Energy to understand market trends and assess investment opportunities throughout the oil and gas industry.

What makes East Daley’s Capital Intelligence analytics so unique?

0

Assets

0

Asset Types

0

Commodities

0

Basins

East Daley Analytics Preview and Review Report

East Daley regularly updates Midstream Company Financials. Clients get access to Preview and Review Reports and Models on each company. This is an example of a previous report on NuStar Energy.

NuStar on Energy Data Studio

The Energy Data Studio platform’s interactive dashboard allows users to easily navigate weekly, monthly, and quarterly updates to individual producers, midstream assets, and midstream company financials, providing flexibility for working with data. It is available through data downloads from the visual interface, in Excel files, or as direct data delivered into subscribers’ workflow via secure file transfer.

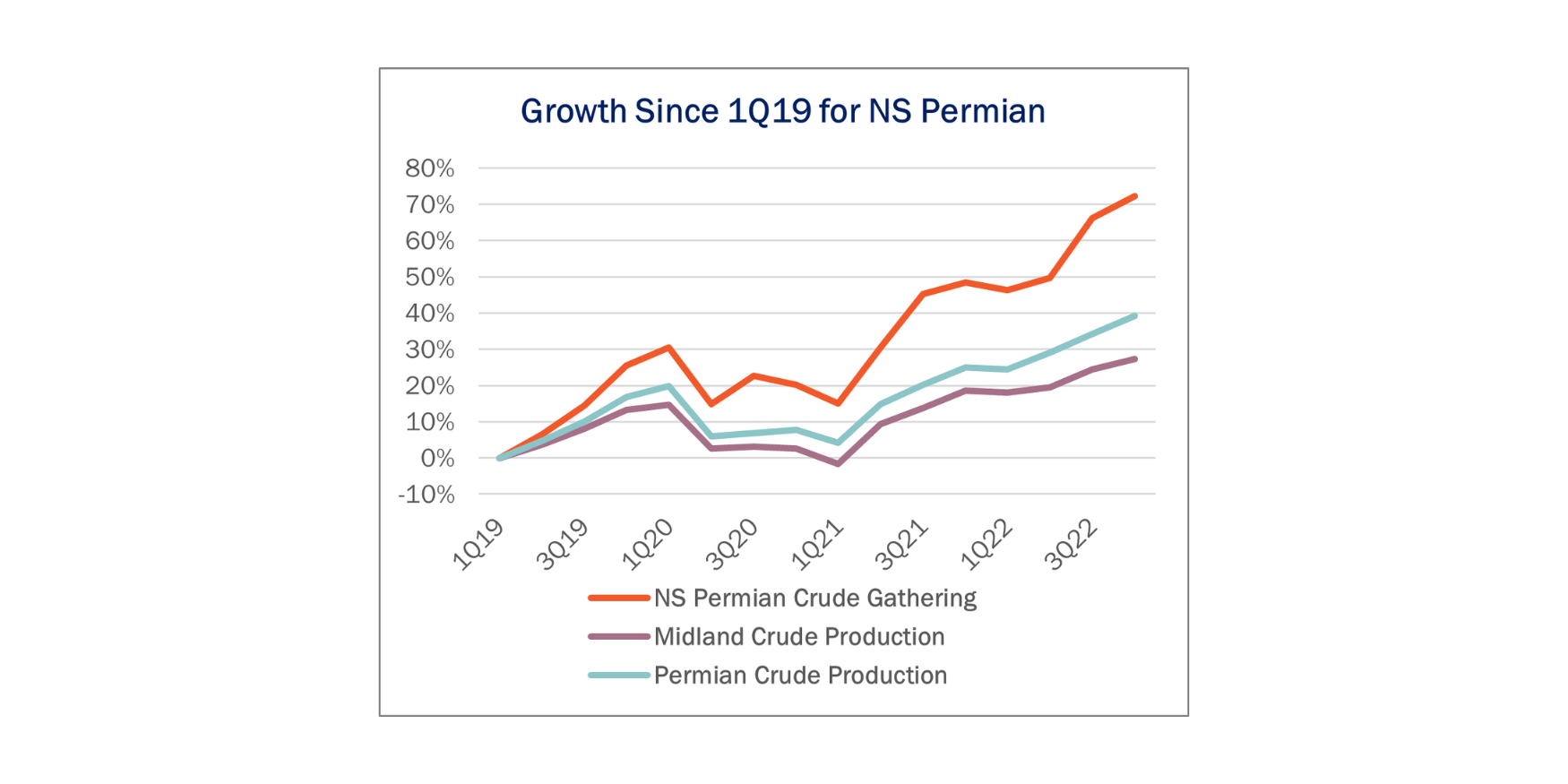

NuStar Guidance: More Conservative than Texas

NuStar (NS) reported positive 4Q22 earnings, beating consensus and East Daley EBITDA expectations by $15 million (8%) and $17 million (10%), respectively. However, what caught our eye was a miss on the company's Permian crude gathering volumes and relatively weak 2023 guidance for the asset.

In 2022, NuStar’s Permian system averaged 584 Mb/d, below management's 600 Mb/d exit-2022 guidance. Management now guides to volumes exiting 2023 at 600 Mb/d, or just 3% growth Y-o-Y. East Daley forecasts crude volumes and performance for the NS – Permian asset in our NuStar Financial Blueprint. We forecast exit-2023 volumes to be 615 Mb/d, or 5.3% growth Y-o-Y on the system.

Read Full Article

Williams (WMB) is pursuing Project Socrates, the latest splashy investment by a midstream company to meet demand for data centers. WMB is...

Hedge fund Citadel has acquired E&P Paloma Natural Gas for $1.2B, setting a high price on acquisitions in the Haynesville. Paloma is a...

Range Resources (RRC) has committed to 20 Mb/d of takeaway and export capacity using a new East Coast LPG terminal, the producer confirmed...

Double H Pipeline’s conversion to NGL service could limit crude oil volumes out of the Guernsey hub and on downstream pipelines. The Kinder...

Natural Gas Weekly

Updates

Dirty Little Secrets

Annual Market Report

.png)