Executive Summary:

Infrastructure: Though crude prices rebounded late in 2Q25, we expect most producers will maintain lower capital budgets.

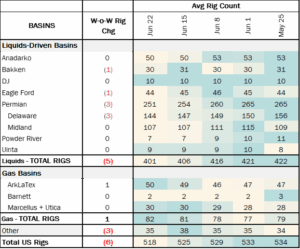

Rigs: The total US rig count decreased during the week of June 22 to 518.

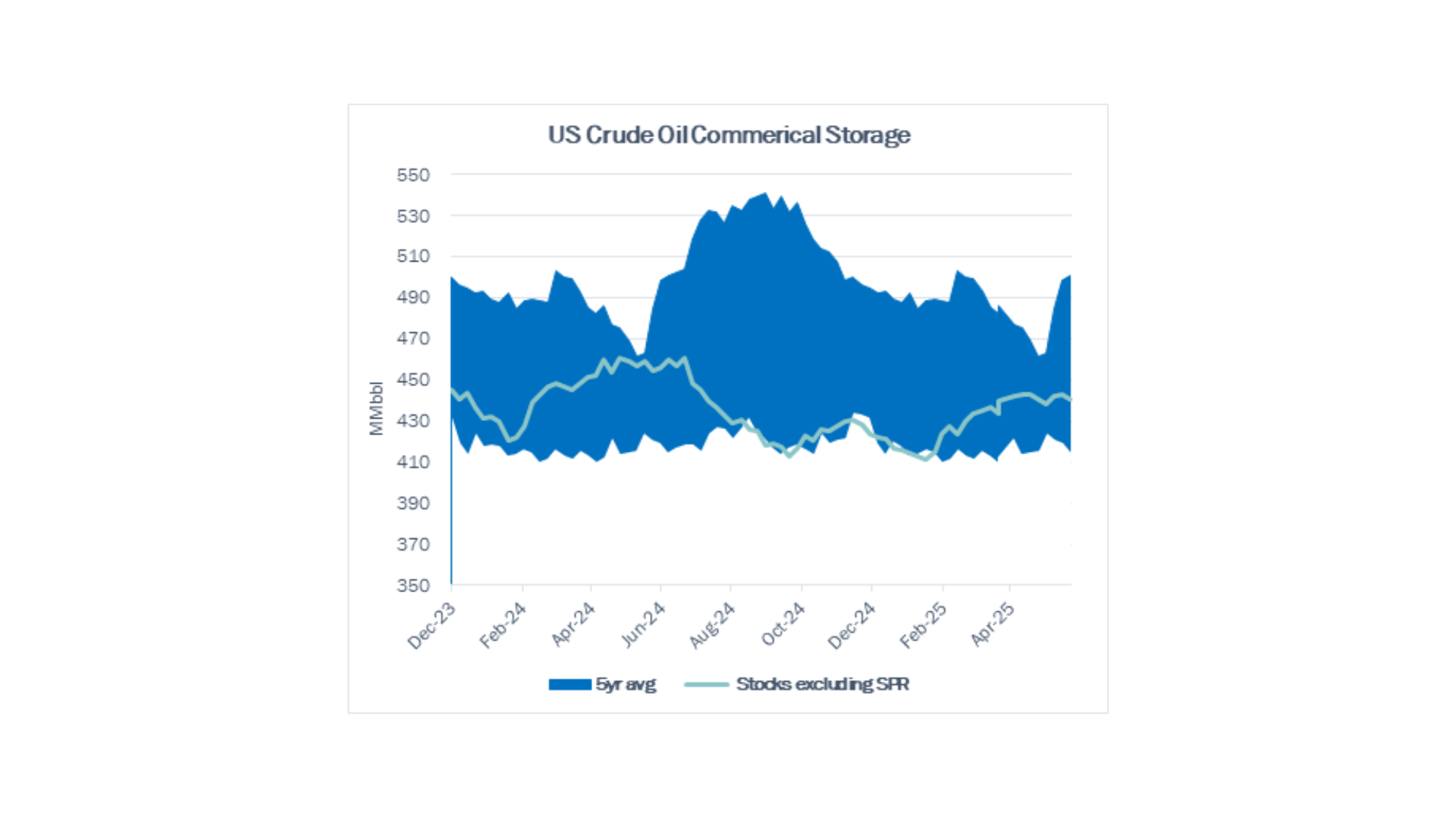

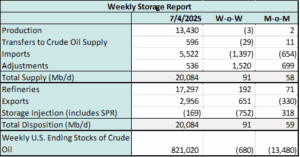

Storage: East Daley forecast a 169 Mbbl withdrawal into storage for the week ending July 4.

Rigs:

The total US rig count decreased during the week of June 22 to 518. Liquids-driven basins decreased by 5 W-o-W from 406 to 401.

- Permian (-3):

-

- Delaware (-3): Permian Resources (-1), Occidental Petroleum (-2)

- Bakken (-1): Hunt Oil

- Eagle Ford (-1): Kimmeridge Texas Gas

Infrastructure:

2Q25 was a wild ride for crude oil markets, driven largely by geopolitical developments. Oil prices fell early in the quarter on fears of a trade war, then rebounded in June as Israel and Iran traded missile strikes. Where does the volatility leave producer budgets for the rest of 2025?

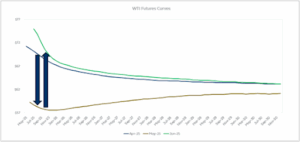

The Trump administration on April 2 announced “Liberation Day,” a new US tariff policy framework that created uncertainty about trade relations and future economic growth. The resulting market anxiety contributed to a sharp decline in crude oil prices, with the WTI forward curve falling from early April (see blue line in the chart below) to May (gold line).

Then in June, when it became evident that the US might escalate its involvement in the Israel-Iran conflict, prices reversed sharply. The WTI forward curve spiked following US airstrikes on three Iranian nuclear sites, as seen in the most recent curve (green line in the chart).

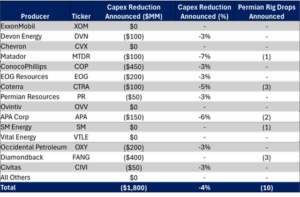

Amid these geopolitical shocks, EDA believes the Permian Basin — the engine of US crude oil production growth — will maintain its slower growth trajectory, anchored to a structurally lower WTI price outlook (gold line). Following the announcement of “Liberation Day,” leading Permian producers collectively cut their capital budgets by nearly $2B (see table).

Rather than increasing guided capex or production targets in response to recent price strength, we expect producers to stay the course for several reasons:

- Logistical bottlenecks remain. There is limited capacity for incremental growth until the Matterhorn Express Pipeline adds 0.5 Bcf/d of gas takeaway lat

er this year, likely in 4Q25. Drilling aggressively into a constrained gas market would force operators to sell associated gas at steep discounts.

er this year, likely in 4Q25. Drilling aggressively into a constrained gas market would force operators to sell associated gas at steep discounts. - Operational moderation. The active rig count in the Permian Basin stands at 255 rigs, down 39 rigs since the start of 2Q25. Growth continues, but at a deliberately slower pace.

- Financial discipline in a volatile environment. In a more volatile WTI price environment, it is easier for management teams to justify conservative capital budgets rather than chase uncertain geopolitical risk premiums.

Structurally, US producers are already adapting by shifting investment toward gas- and NGL-rich basins, where demand growth is expected from LNG exports, data centers, and petrochemical feedstock markets. While the Permian will remain a critical source of US crude supply, we do not anticipate a large-scale resurgence in rigs in response to short-term price fluctuations.

Storage:

East Daley expects a 169 Mbbl withdrawal into commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending July 4. We expect total US stocks, including the SPR, will close at 821 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased 0.82% W-o-W across all liquids-focused basins. Samples increased 4.04% in the Permian Basin, 3.98% in the Bakken, and 2.39% in the Rockies. However, these gains were partially offset by decreases of 2.74% in the Anadarko and 0.26% in the Gulf of Mexico. The Rockies and the Gulf have a high correlation between gas volumes and crude oil volumes, whereas the Permian and Eagle Ford basins correlation is less than 45%.

We expect US crude production to average 13.43 MMb/d. According to US bill of lading data, US crude imports decreased to 5.5 MMb/d. More than 60% of the supply originated from Canadian pipelines and vessels into the US, with the remainder largely coming from vessels carrying crude from Mexico and Nigeria.

As of July 4, there was ~289 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude input into refineries to increase, coming in at 17.30 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 16 vessels loaded for the week ending July 4 and 23 the prior week. EDA expects US exports to average 2.96 MMb/d.

The SPR awarded contracts for 6.0 MMbbl to be delivered to Choctaw February–May ‘25 and 2.4 MMbbl to be delivered to Bryan Mound April–May ‘25. The SPR has 402.6 MMbbl in storage as of July 4, 2025.

Regulatory and Tariffs:

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Bridger Pipeline, LLC Rates were increased by the FERC index. Joint rates are less than or equal to the sum of the local rates. Effective July 1, 2025.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/