Happy anniversary, TMX. One year out from the widely anticipated looping project, Trans Mountain Pipeline is weighing further expansions to boost crude oil exports from the Pacific coast.

Canada’s only dedicated oil export pipeline is exploring both short- and long-term projects to increase capacity by 200-300 Mb/d, Trans Mountain reported in its 1Q25 results. The government-backed pipeline is considering several options, from using drag-reducing agents (DRAs) to adding more pump stations to increase throughput.

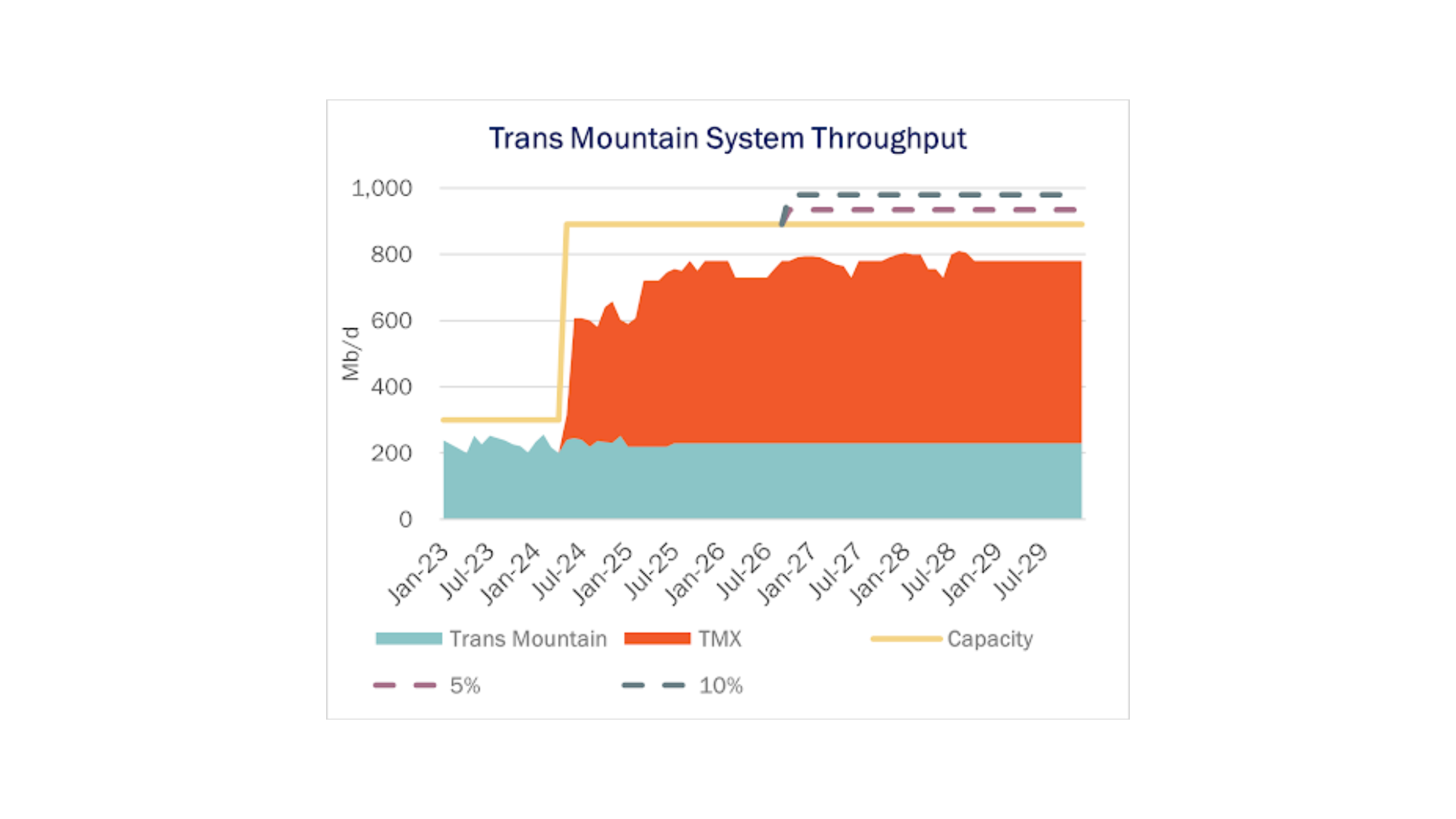

The Trans Mountain expansion (TMX) began commercial operations in May 2024, adding 590 Mb/d of capacity from Alberta to the Westport Terminal in Burnaby, British  Columbia. The project has helped diversify markets for Canada’s crude oil while spurring upstream expansions in the Western Canadian Sedimentary Basin (WCSB).

Columbia. The project has helped diversify markets for Canada’s crude oil while spurring upstream expansions in the Western Canadian Sedimentary Basin (WCSB).

In an interview with the Calgary Herald, Trans Mountain CEO Mark Maki said DRA testing is already underway. Blending DRAs into the crude stream could increase the system’s capacity by 5-10% at a low capital expense. The pipeline is also working on early engineering plans to increase the number of pump stations, Maki said. The additional compressors could increase capacity to nearly 1.14 MMb/d by the end of the decade, though at a significantly higher cost (see figure).

Trans Mountain reported 1Q25 throughput of 757 Mb/d, or 85% utilization of its current 890 Mb/d capacity. According to East Daley’s Crude Hub Model, the Trans Mountain system operated at 68% utilization in December ‘24 (based on the most recent CER data), compared to 97% for Enbridge’s (ENB) Mainline and 100% for South Bow’s (SOBO) Keystone pipelines over the same period.

Trans Mountain’s announcement comes months after ENB announced plans for additional WCSB egress via a 30 Mb/d expansion on the Express-Platte system and the Mainline Phase 1 expansion of 150 Mb/d.

Given expected growth in WCSB oil production, the three pipeline expansions are essential to prevent bottlenecks and avoid discount economics for heavy crude, according to the Crude Hub Model. The Trans Mountain system serves West Coast refiners and export terminals, with ~50% of exports bound for the US West Coast and the other 50% destined for Asia. ENB’s Canadian egress routes supply refiners in PADDs 2, 3 and 4, and connect to Gulf Coast export terminals for shipments to Europe. – Gage Dwan Tickers: ENB, SOBO.

NEW – July Production Webinar

Join East Daley on July 9 for the Monthly Oil & Gas Production Webinar – your essential update on the latest production trends and midstream impacts across natural gas, NGLs and crude oil. Our experts unpack the latest rig trends, basin-level supply shifts, and midstream constraints shaping commodity markets. Join us on July 9!

NEW – The Burner Tip

The Burner Tip provides East Daley’s weekly coverage of natural gas markets. Every Thursday, The Burner Tip brings you our expert perspective on drivers shaping prices and flows in North America — including production trends, infrastructure dynamics, and forward-looking fundamentals — all grounded in EDA’s proprietary data and models. Whether you’re trading, investing, or managing risk, The Burner Tip delivers the insights you need to drive smarter strategy. Subscribe now to The Burner Tip!

Data Center Demand Monitor – Available Now!

Introducing Data Center Demand Monitor by East Daley Analytics. This is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.