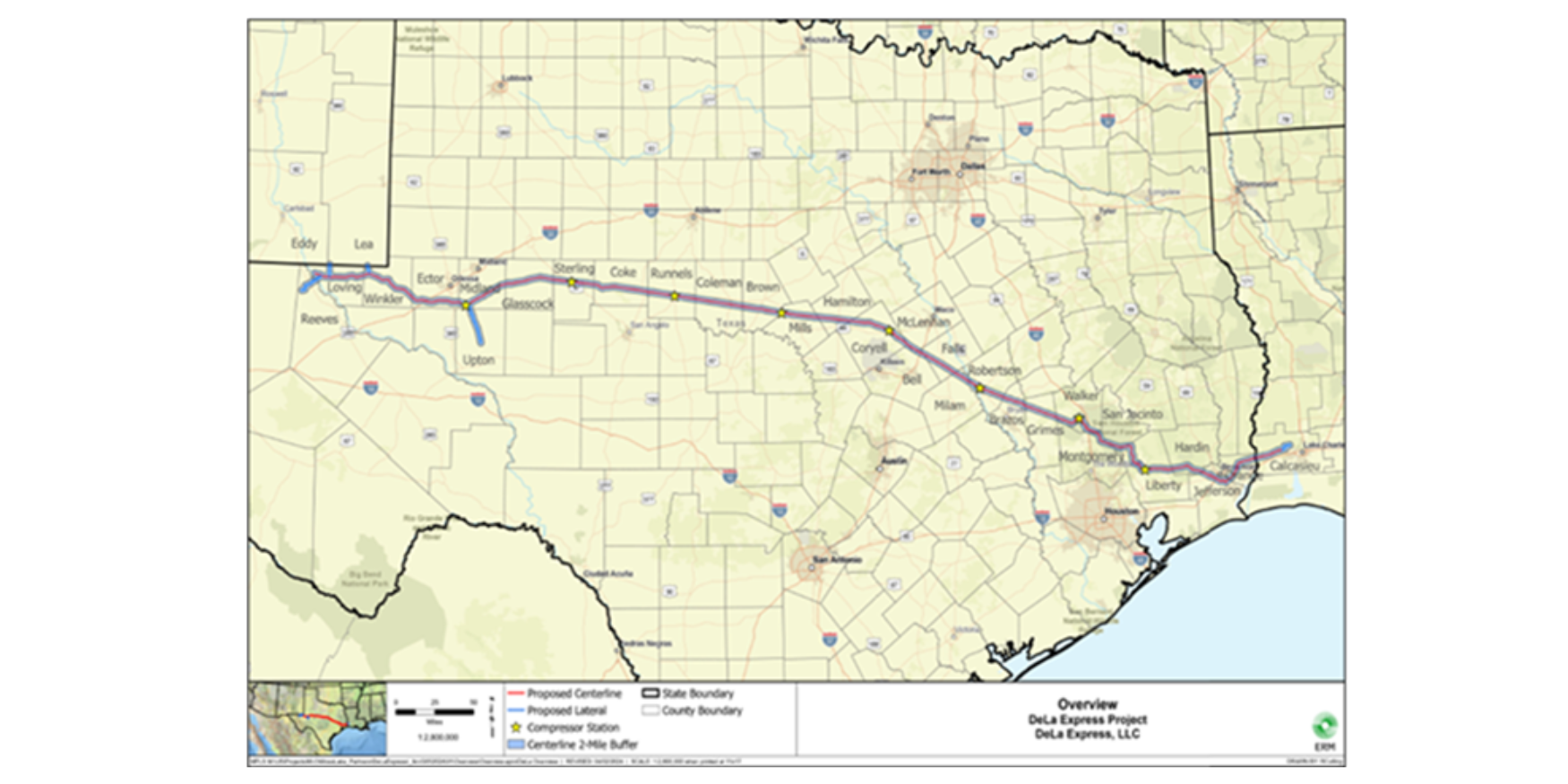

TETCO Readies Pipeline to Serve New LNG Project

Comments: 0

Federal regulators have given Enbridge (ENB) the green light to start a new pipeline serving an LNG project finishing construction on the Louisiana ...

Read